Our previous post introduced you to the 7 elements of the DELTA plus model for analytics. The model originated from the book, Competing on Analytics, by authors Thomas Davenport and Jeanne Harris. The book also talks extensively about analytics maturity stages for companies who have delved deep into data and analytics. And guides on how companies should attain the next level of maturity with analytics.

Now that you know about the elements of the DELTA plus model, you can analyze how strong these pillars are in your organization. So, let’s walk you through the various stages of analytics maturity. This post will help you analyze the missing part in the puzzle—or the weaker link—that can take you to higher rungs in analytics maturity.

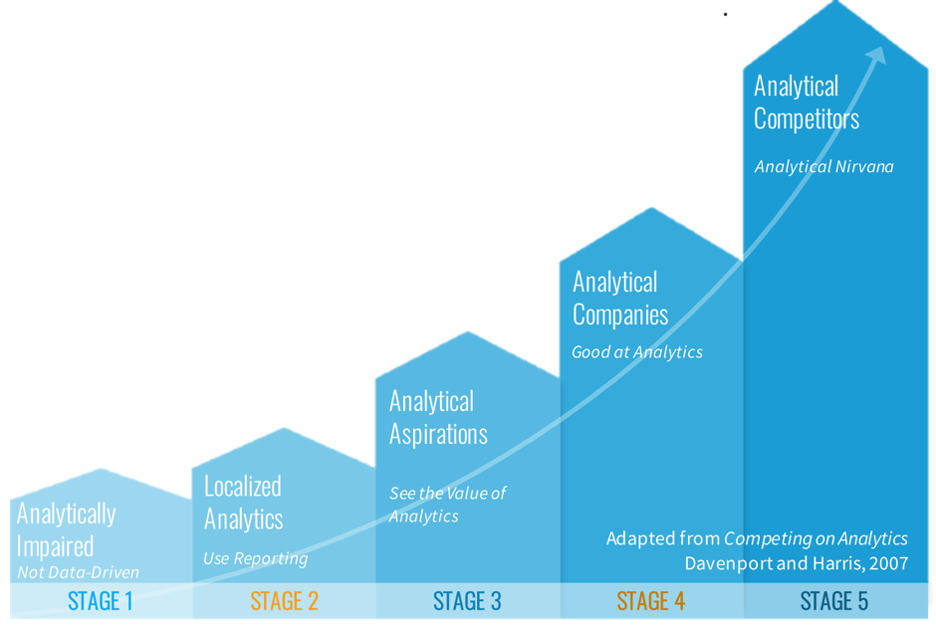

What are the 5 Stages of Analytics Maturity?

An organization using analytics in business can be nourishing the 7 DELTA elements at various levels. Based on how mature they are at these elements also defines their stage of maturity in the analytics journey. Here are the 5 stages according to the Davenport and Harris analysis.

Stage# 1: Analytically Impaired

Businesses that have not given much thought to harness the power of data are in this category. They may still be using more papers than digital tools effectively.

Such organizations have been least focused on collecting and use data and lack an enterprise resource planning (ERP) system. Even if they have deployed an ERP system, they may not have given a thought to wrangle the collected data. Or they have not maintained a proper system to keep records for longer runs.

These companies don’t make data-driven decisions. They are comfortable making decisions on some vague parameters and gut feelings. Such decision-making efforts can make them successful only by sheer luck. The leadership may not have explored the data-driven culture and don’t encourage employees to utilize the data at their disposal (if any) to analyze what happened and why.

Stage# 2: Localized Analytics

Such companies that have explored data and analytics to the fundamental level sit in this category. They know the power of data and analyze data for hindsight using reports, excel based systems, or some primitive technology.

Instead of making analytics-oriented decisions, executives demand analytics be done for decision-based actions. Unfortunately, this reverse process mars the idea of data-driven growth.

Most of the departments behave as separate islands of data. And the bridge between these islands is missing to traverse the data from one cluster to another. Owing to this lack of a bird’s-eye view of the information system, the uniformity in data is missing.

You might find multiple versions of truth and an absence of a cross-functional analytical system. This ultimately leads to a conflict in targets defined at the organization level and department level.

Stage# 3: Analytical Aspirations

Companies in this stage know the importance of data, its proper management, and analytics. Therefore, they make keen efforts to utilize the available data and make decisions based on the insights produced.

The management of these companies understands and uses data for making decisions. And hence, the islands of data begin to merge into more significant and unified data repositories. However, they still lack an enterprise-wide vision. Analytical abilities for such companies are aimed at smaller targets.

Brands in the analytical aspirations zone move just beyond using descriptive analytics. They show signs of using predictive analytics and value their analysts. These companies are in the early stages of making investments in building up a company-wide data management system. They also value recruiting specialized talents.

Companies in the analytical aspirations area try to use analytics to find and establish their competitive differentiator.

You might like to read about the Analytics Maturity Curve based on the level of analytics you are performing.

Stage# 4: Analytical Companies.

Highly data-oriented companies fall in this stage. These companies are matured enough in collecting and using data and analytics to their advantage.

With good coordination across the organization, these companies deploy hybrid or centralized data management systems and sophisticated tools for analytics. This gives them a near-single point of truth with integrated and accurate data.

Analytical endeavors are driven chiefly by organization-level business targets. The alignment of significant business visions (not all of them, though) with data results from a leadership team that believes in analytics competence.

Companies in this stage use advanced analytics with machine learning and, perhaps, IoT to get the bulk of data for analysis. This allows them to cash on predictive analytics with a focus on knowledge gathering.

However, lack of innovations and single-minded goals at all levels are certain limitations they need to overcome to become analytics champions.

Stage# 5: Analytical Competitors.

With focused goals, both from a business perspective and analytics, the companies in this stage are the champions in using analytics and data. They strategically plan their roadmaps to the long-term and short-term goals backed by data-driven decisions.

Analytics and data are not their forte but competitive weapons to stand out and achieve targets.

Executives and higher management rely upon the latest tools and technologies that help them to refine their analytical endeavors. For example, they use artificial intelligence and machine learning for decision-making. And also create their own models and algorithms rather than leaning on only third-party tools.

Their analytics is highly matured with autonomous capabilities like answering complex questions about future business possibilities. Analytical competitors use real-time big data, social media inputs, and unstructured data (videos, texts, and images) to serve their customers.

These companies thrive on a centralized data management system and boast experts like data scientists and data engineers.

Are Analytics Maturity and DELTA plus Valid for All Industries?*

Yes, of course. Any company using analytics can use DELTA plus elements and 5 stages of analytics maturity to assess their progress.

If Caesars Entertainment in the gaming industry and Netflix in streaming entertainment are the analytical competitors, we have Nike in consumer sports and Visa in financial services.

Even the global cement industry ace, CEMEX, is thriving on analytics. They have used data extensively and applied analytics for optimizing supply chains and delivery times. Davenport and Harris never expected the fashion industry to be influenced by analytics, but they found a lot of analytics-based predictions that run the industry.

Where Do You Stand on Analytics Maturity?

If analytics isn’t the profit center of your organization and is not helping you thrive, it’s high time you start thinking in this direction. Not only with advanced tools and technologies but by inculcating an analytic-driven culture and data literacy.

Should you need some help in establishing a vantage point with analytics in business, team Logesys would be happy to help. We have been helping our customers in various industries for more than a decade. You can reach out to us here and initiate a discussion.

Notes-

*: examples are from the book mentioned in this post.